Starting your investment journey can be thrilling and a bit scary if you’re new to finance. But, with the right knowledge and advice, investing can be a strong way to reach your financial goals. This guide will cover the basics of investing, talk about different investment options, and give you strategies to feel confident in the markets.

Before we get started, let me ask you a question: Are you ready to take charge of your financial future? This guide will shake up your ideas about investing and give you the tools to make smart choices that fit your financial goals.

Create an image of a person standing at a crossroads, with one path labeled “Investing” and the other labeled “Spending.” The person is looking back and forth between the two paths, appearing thoughtful and hesitant. In the background, there are various symbols of financial growth, such as a rising graph or a pot of gold. The colors should be bright and optimistic, but with hints of caution to convey the importance of careful decision-making when it comes to investing.

Key Takeaways

- Investing is key to personal finance and can help you grow your wealth over time.

- It’s vital for beginners to understand investing basics, including different types of investments and how to manage risks.

- Creating a strong investment plan, setting financial goals, and knowing your risk level are important first steps.

- Diversifying and spreading out your investments are key to handling risks and getting good returns.

- Planning for retirement and understanding taxes are crucial for long-term investing that beginners should know.

What is Investing and Why is it Important?

Investing means putting your money into things that might make more money over time. Investing basics include learning about financial markets, the types of assets you can buy, and how risk and reward are linked. By learning about investment fundamentals, you can grow your wealth, reach your financial goals, and secure your future.

Understanding the Basics of Investing

Investing is about making your money work for you. You can do this through assets like stocks, bonds, mutual funds, and ETFs. Each type has its own risk level and possible returns. Knowing these is key to making smart investment choices.

The markets where investments are traded can be tricky and unpredictable. But, by learning about investment fundamentals, you can make better decisions. This helps you meet your financial goals and manage your risk.

Benefits of Long-term Investing

Long-term investing lets your money grow over time through compound growth. This means your earnings can make more money, helping you beat inflation and build wealth.

- Patience and discipline are key for long-term investing, as markets can go up and down.

- By investing for the long haul, you can handle market ups and downs better. This might lead to higher returns than trying to time the market.

- Long-term investing can help you reach big financial goals, like saving for retirement, education, or a house.

Investing is vital for managing your money and growing your wealth. By grasping investment fundamentals and thinking long-term, you’re on the right path to a secure financial future.

A tree growing tall and strong, with roots deeply embedded in the earth. Its branches stretch out far, reaching towards the sky. In the distance, a horizon of rolling hills and mountains can be seen. The sun casts a warm glow over everything, signaling the promise of growth and prosperity.

Developing a Solid Investment Strategy

Creating a strong investment strategy is key to reaching your financial goals. It doesn’t matter if you want quick gains or long-term wealth. A clear strategy makes investing easier and more confident.

Setting Financial Goals

Start by setting clear financial goals. These could be saving for a house, your kids’ education, or retirement. Having specific, measurable, and timely goals helps guide your investment choices.

- Short-term goals (1-3 years): e.g., saving for a vacation or emergency fund

- Medium-term goals (3-10 years): e.g., saving for a down payment on a home or a child’s college education

- Long-term goals (10+ years): e.g., building wealth for retirement or leaving a legacy

Defining Your Risk Tolerance

Understanding your risk tolerance is vital for your investment strategy. It’s about how much risk you can handle for your financial goals. Your age, how long you have to invest, and your financial situation affect your risk tolerance.

| Risk Tolerance Level | Investment Approach | Potential Returns | Potential Risks |

|---|---|---|---|

| Low | Conservative, emphasis on stability and preservation of capital | Lower | Lower |

| Moderate | Balanced, seeking a mix of growth and stability | Moderate | Moderate |

| High | Aggressive, focused on maximizing growth | Higher | Higher |

Match your investment strategy with your risk tolerance. This way, you can have a portfolio that supports your goals without causing stress.

Create an image of a map with various investment options, each represented by a different symbol. The map should be surrounded by arrows and directions pointing towards the different options, emphasizing the importance of selecting a solid investment strategy. The symbols should include stocks, bonds, real estate, and mutual funds to represent a diverse portfolio. Show the symbols arranged in a way that suggests balance and stability.

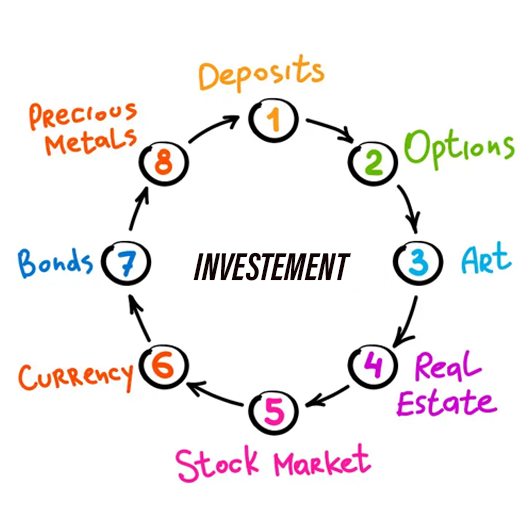

Types of Investment Vehicles

Investing your money is key to building wealth and securing your financial future. There are many options to choose from, each with its own risks and benefits. Let’s look at stocks, bonds, mutual funds, and ETFs.

Stocks

Stocks let you own part of a company. Your investment’s value changes with the company’s performance. Stocks can grow in value and may give dividends, a share of profits. But, they can also be risky, with prices changing a lot.

Bonds

Bonds are like loans to governments or companies. You lend money and get back the principal plus interest over time. They’re seen as safer than stocks, with a steady income. But, they don’t usually grow as much in value.

Mutual Funds

Mutual funds pool money from many investors to buy different securities. They’re managed by experts who pick investments for you. Mutual funds offer diversification and professional management but have fees that can affect your returns.

Exchange-Traded Funds (ETFs)

ETFs are like mutual funds but trade on stock exchanges like stocks. They follow a specific index or sector, making it easy to invest in many areas with one security. ETFs often have lower fees than mutual funds, making them a cost-effective choice.

When picking investments, think about what each offers and how it matches your goals and risk level. Knowing about these options helps you make smart choices for your financial future.

Understanding Asset Allocation

Asset allocation is key to a strong investment plan. It means spreading your money across different types of investments like stocks, bonds, and cash. This helps manage risk and aim for better returns. The right mix depends on your goals, how long you can wait, and how much risk you can handle.

Asset allocation works by using different investments that do well in different market conditions. By mixing these, you can lower the risk of your investments. This might also help you earn more over time.

Factors Influencing Asset Allocation

Several things affect the best asset allocation for you:

- Risk Tolerance – How well you can handle changes in your investment values.

- Time Horizon – How long you plan to keep your investments before needing the money.

- Financial Goals – What you’re saving for, like retirement or a house.

- Tax Considerations – How taxes affect investments like bonds or real estate.

Think about these factors to create an asset allocation plan that fits your financial needs and likes.

Diversifying Your Portfolio

Asset allocation helps with diversification. By investing in different types of assets, you can lower your portfolio’s risk. This is because different investments do well in different market times. So, if one investment is down, another might be up.

The table below shows how different assets have done over the past decade:

| Asset Class | Average Annual Return (2011-2020) |

|---|---|

| U.S. Stocks | 14.5% |

| International Stocks | 5.5% |

| U.S. Bonds | 3.8% |

| Cash | 0.8% |

By mixing these assets, you can lower the risk and still aim for growth. Stocks, for example, can be riskier but also offer higher potential returns.

“Asset allocation is the most important decision an investor can make. It’s more important than market timing or stock selection.” – David Swensen, Chief Investment Officer, Yale University.

Creating a good asset allocation plan is key to a diverse investment portfolio. It should match your financial goals and how much risk you can take. Understanding asset allocation helps you move closer to your investment goals.

Diversification: The Key to Risk Management

As an investor, managing risks in your portfolio is crucial. Diversification helps with this. It means spreading your investments across different types of assets and areas to lessen the effect of one investment doing poorly.

What is Diversification?

Diversification is a way to lower the risk in your investments. It means putting money into various assets to avoid big losses if one investment fails. This strategy makes your portfolio less dependent on just one investment’s success or failure.

Benefits of Diversification

Diversifying your investments has many advantages:

- Reduced Volatility: Spreading your money across different areas helps even out your portfolio’s performance. This leads to a more stable investment experience.

- Improved Risk-Adjusted Returns: Diversification can lead to better long-term returns while keeping risk in check.

- Mitigation of Concentration Risk: Putting all your money in one place can be risky. Diversification lowers this risk.

To diversify well, look at different investment options like stocks, bonds, mutual funds, and ETFs. A diversified portfolio gives you confidence and security in the investment world.

Remember, diversification doesn’t guarantee success, but it’s a strong risk management tool. By applying diversification to your strategy, you’re on your way to a more stable and rewarding portfolio.

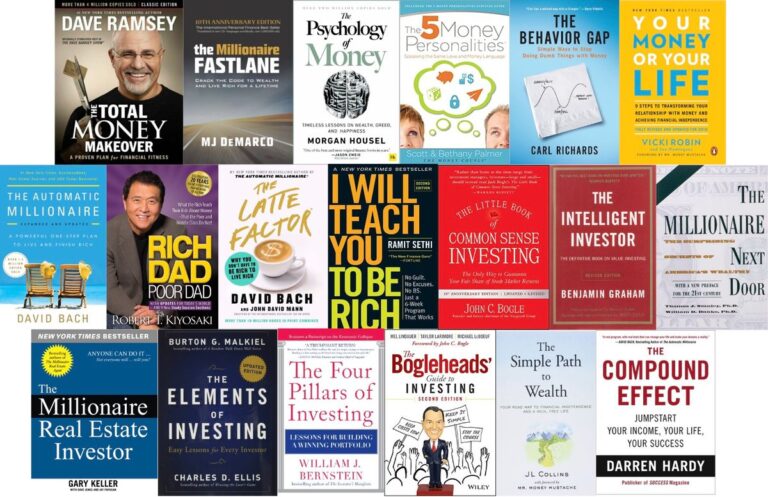

“Investing for Beginners: A Comprehensive Guide to Get Started”

This guide has given you the key knowledge and strategies to start investing with confidence. It’s time to recap the main points that will help you in the investing world as a beginner.

First, it’s important to understand investing basics. You’ve learned that it’s about using your money or time to make more money in the future. You’ve seen how long-term investing can lead to wealth through compounding and growth.

Creating a strong investment plan is vital. This means setting financial goals, knowing how much risk you can handle, and picking the right investments. You now know about stocks, bonds, mutual funds, and ETFs, giving you many options.

Diversification is key to managing risk well. By spreading your investments across different areas, you reduce the risk of losing a lot of money. This helps protect your investments from big market changes.

As you keep investing, staying patient and disciplined is crucial. Emotions can lead to bad decisions, so managing them is important. Stick to your plan and avoid quick, emotional choices to reach your financial goals.

Investing is a journey, not just a goal. This guide has given you a solid start. But, the real learning and growth come from ongoing education, experience, and sticking to good investment rules.

Investing for Retirement

Retirement is a big financial step. It’s important to invest wisely for this stage of life. 401(k) plans and Individual Retirement Accounts (IRAs) are two top choices for retirement savings. Knowing how they work can help you make the best choices for your retirement investing and future security.

401(k) Plans

A 401(k) plan lets you save a part of your paycheck before taxes are taken out. The money in your 401(k) grows without taxes until you take it out in retirement. Many employers also add money to your 401(k), which can really help your savings grow.

One great thing about 401(k) plans is automatic savings through payroll deductions. This makes saving easier. Plus, you can save more in a 401(k) than in IRAs, which helps with your retirement planning.

Individual Retirement Accounts (IRAs)

IRAs are personal savings plans for retirement that come with tax benefits. There are traditional and Roth IRAs. Traditional IRAs use pre-tax money, while Roth IRAs use after-tax money. Both grow without taxes until you take the money out, but how you’re taxed then is different.

IRAs are more flexible than 401(k) plans. You can start one even if you’re not working. This makes them great for retirement investing, especially if you’re self-employed or don’t have a job plan.

Choosing between a 401(k) and an IRA depends on what’s best for you. But the main thing is to start saving and investing for retirement early. The power of compound interest can greatly improve your retirement planning efforts. So, don’t wait to use these important investment tools.

Analyzing Investments: Fundamental and Technical Analysis

Investing can seem tough, especially for newbies. But learning about investment analysis can help you make smart choices. It can lead you to reach your financial goals. There are two main ways to do this: fundamental analysis and technical analysis.

Fundamental Analysis looks at the real value of an asset by checking its financial and economic details. It looks at a company’s financial statements, industry trends, and management. This helps investors find assets that are priced too low or too high.

Technical Analysis uses past price and volume data to spot patterns and trends. It believes market behavior follows certain patterns. These patterns can help predict future prices. Technical analysts use charts and algorithms to find these patterns.

Using both fundamental analysis and technical analysis together gives a fuller view of investments. This way, investors can make better choices for their portfolios. By combining these methods, investors can create a strong investment strategy.

| Fundamental Analysis | Technical Analysis |

|---|---|

| Focuses on the intrinsic value of an asset | Focuses on the historical price and volume data of an asset |

| Analyzes financial statements, industry trends, and management | Uses charts, indicators, and algorithms to identify patterns and trends |

| Aims to identify undervalued or overvalued assets | Aims to predict future price movements based on past behavior |

Learning about fundamental and technical analysis helps you make better investment choices. It’s useful whether you’re just starting or have been investing for a while. These skills are key to achieving financial success.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

Investment Accounts and Brokers

Starting to invest can be thrilling, but knowing how to set up your accounts and pick a brokerage firm is key. We’ll walk you through opening an investment account and picking a brokerage that fits your goals and likes.

Opening an Investment Account

The first step is to open an investment account. There are many types, each with its own perks. Here are some common ones:

- Brokerage accounts: These let you invest in things like stocks, bonds, and mutual funds.

- Individual Retirement Accounts (IRAs): These are for saving for retirement and have tax benefits.

- Employer-sponsored retirement plans: These are offered by some employers and let you invest through them.

To open an account, you’ll give personal info like your name and Social Security number. You might also tell about your investment goals and how much risk you can handle.

Choosing a Brokerage Firm

After setting up your account, pick a brokerage firm to manage your investments. These firms offer different services and features. It’s important to find one that meets your needs. Consider these factors:

- Fees and commissions: Look at the costs for trading, keeping your account, and other services.

- Investment platforms and tools: Check how easy and useful the firm’s online tools and resources are.

- Customer service: Think about how easy it is to get help from the firm’s support team.

- Reputation and regulatory compliance: Make sure the firm is trusted, established, and follows the rules.

By looking at your options and choosing the right brokerage, you’re setting up for a strong investment portfolio.

Tax Considerations for Investors

Understanding taxes is key for investors. Tax planning can greatly affect your investment returns. Knowing about tax considerations helps you make better choices and improve your investments for taxes.

Capital Gains Taxes

When you sell an investment for more than you bought it for, you might face capital gains taxes. These taxes depend on your income and how long you held the investment. Knowing about these taxes helps you plan your investments.

Dividend Taxes

Investments like stocks can give you dividends, which are taxed. The tax rate on dividends varies based on the investment and your tax situation. It’s good to know how dividends are taxed to make smart choices about your investments.

Retirement Account Taxes

Money in retirement accounts like 401(k)s and IRAs gets special tax treatment. Putting money into these accounts might let you deduct your contributions. The money grows without being taxed, but taking it out later might be taxed. Knowing how these accounts work is important.

| Investment Type | Tax Consideration | Potential Tax Benefit |

|---|---|---|

| Taxable Brokerage Account | Capital Gains Taxes | Qualified long-term capital gains are taxed at a lower rate (0%, 15%, or 20%) compared to ordinary income tax rates. |

| Dividend-Paying Investments | Dividend Taxes | Qualified dividends are taxed at the same favorable long-term capital gains rates, potentially lower than ordinary income tax rates. |

| Retirement Accounts (401(k), IRA) | Tax-Deferred or Tax-Free Growth | Contributions may be tax-deductible, and growth within the account is typically tax-deferred or tax-free. |

Knowing how taxes affect your investments helps you make better choices. This can lead to higher returns through smart tax strategies. Always talk to a tax expert to use tax benefits and reduce your taxes.

Developing a Successful Investing Mindset

Investing is more than just picking stocks or timing the market. It’s about having the right mindset. This mindset includes patience, discipline, and emotional intelligence. These traits help you deal with the ups and downs of investing.

Patience and Discipline

Investing is a long-term game. The best investors know the value of patience and discipline. They don’t let short-term market changes make quick decisions. They keep their focus on long-term goals.

By being disciplined, investors can handle market changes well. They stay on track towards their goals.

Emotional Intelligence in Investing

Investing can be very emotional. Emotional intelligence is key to making good investment choices. Successful investors know how to handle their feelings like fear and greed. These feelings can lead to bad decisions.

By being aware of their emotions, investors can make choices that fit their long-term plans. This helps them stay on track.

Building a strong investing mindset takes time and effort. It’s about learning, reflecting, and adapting to new market situations. With patience, discipline, and emotional intelligence, investors can confidently navigate the financial markets and reach their goals.

“Investing is not about beating others at their game. It’s about controlling yourself at your own game.” – Benjamin Graham

Conclusion

As you finish this investing guide summary, think about the main points and strategies we’ve covered. Investing is a great way to reach your financial goals. This could be saving for retirement, a home down payment, or growing your wealth over time.

The investment strategies review has given you a strong base to create a plan that fits your risk level, time frame, and financial goals. Remember, investing well needs patience, discipline, and knowing how the market works. But, the benefits can be big.

Use what you’ve learned and start making it happen. Spread out your investments, check and adjust them often, and keep up with market trends and economic news. By being active and well-informed in your investing, you can manage your financial future. This will help you secure your financial well-being for the long run.

FAQ

What are the key benefits of long-term investing?

Long-term investing has many benefits. It helps your money grow over time. It also helps you beat inflation and handle market ups and downs. This way, you can reach your financial goals faster.

How do I define my personal risk tolerance?

Knowing how much risk you can handle is key to a good investment plan. Think about how long you plan to invest, your financial goals, and how you feel about market changes. This will help you pick investments that fit your comfort level and goals.

What are the different types of investment vehicles I should consider?

You should look into stocks, bonds, mutual funds, and ETFs. Each type has its own risks and rewards. Spreading your money across these can help you manage risk and increase your chances of making money.

How does asset allocation play a role in investment success?

Asset allocation means spreading your money across different types of investments. The right mix depends on your goals, how much risk you can take, and when you plan to need the money. Getting it right can help you manage risk and boost your returns over time.

Why is diversification important for risk management?

Diversification is a key way to manage risk. It means investing in a mix of assets to reduce the impact of any one investment’s bad performance. This approach can lower the chance of big losses and protect your investments from market risks.

How can I optimize my investments for retirement?

For retirement, use accounts like 401(k)s and IRAs. These accounts offer special tax benefits that can help your investments grow. Using these accounts wisely can help you reach your retirement goals.

What are the differences between fundamental and technical analysis?

Fundamental analysis looks at a company’s financials and its place in the market. Technical analysis uses past market data to spot trends and opportunities. Both methods can help you make better investment choices.

What should I consider when choosing an investment account and brokerage firm?

When picking an investment account and a brokerage firm, think about what they offer. Look at fees, customer service, and the firm’s reputation. Choosing the right platform can greatly affect your investment success.

How can I develop a successful investing mindset?

To succeed in investing, be patient, disciplined, and emotionally smart. Keep focused on your goals and avoid quick decisions. These traits can lead to better investment choices.