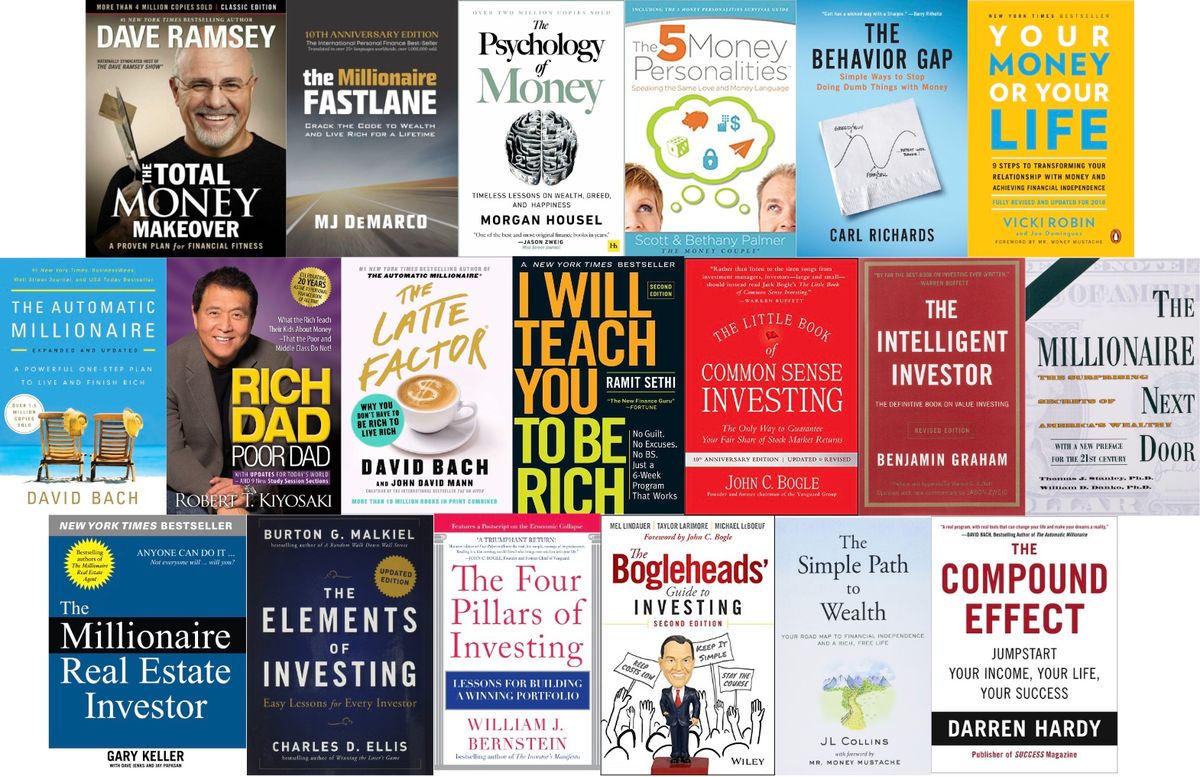

Understanding personal finance can seem tough, but the right books can help. This article will look at seven key financial books. They can change how you think about money and help you reach financial success.

These books cover many topics, from basic finance to building wealth. You’ll learn from experts like Robert Kiyosaki, David J. Schwartz, and Jim Collins. By reading these financial books, you can take charge of your money and move towards financial freedom.

Key Takeaways

- Discover seven essential personal finance books that can change your financial life

- Gain insights into assets, liabilities, and the importance of financial education

- Learn how to cultivate a positive mindset for wealth creation and success

- Uncover the secrets of the “Millionaire Next Door” and the power of index investing

- Explore a range of money management books that cover diverse financial topics

The Importance of Financial Education

Learning about money is key to getting ahead financially. Many people don’t know how to handle their money well. By reading books on finance, you can learn important stuff like the difference between what you own and what you owe. You’ll also learn how to build wealth.

Gaining Knowledge for Wealth Creation

These books help you fight financial illiteracy and build a solid financial base. This lets you make smart choices and control your financial future. A 2021 survey showed that only 20% of payments were in cash, while 28% were on credit cards. This shows how crucial financial knowledge is today.

“The Simple Path to Wealth” talks about saving and investing early to grow your money over time. “The Millionaire Next Door” says many rich people save and invest instead of spending a lot. “Rich Dad Poor Dad” teaches the value of learning about money and investing in things that make more money.

Overcoming Financial Illiteracy

Only 28% of Americans have saved for retirement, says the U.S. Federal Reserve System Board of Governors. Also, only 19% of millennials know a lot about personal finance. They got most questions about money right.

Books like “The Total Money Makeover” by Dave Ramsey and “Your Money or Your Life” give practical advice and stories to inspire you. They talk about budgeting, saving, investing, managing debt, and understanding credit. These books help you get the financial knowledge and tools you need to build wealth.

“Financial literacy is the ability to understand how money works in the world – how someone manages to earn or make it, how that person manages it, how he/she invests it (turn it into more) and how that person donates it to help others.” – Robbin S. Simons

Rich Dad Poor Dad: Insights on Assets and Liabilities

Robert Kiyosaki’s book, “Rich Dad Poor Dad,” changed how we think about money. It compares the views of Kiyosaki’s two dads on assets and liabilities. Kiyosaki says the secret to wealth is owning assets that make money on their own.

This book shows us how to think differently about money. It teaches the importance of financial education. It helps us understand how to shape our financial future.

Since 1997, “Rich Dad Poor Dad” has become a huge hit in finance circles. It has sold millions of copies worldwide. The book teaches us about financial education and making smart money choices.

Kiyosaki explains that assets make money, while liabilities cost money. He believes that having a job won’t make you rich. Instead, starting a business and investing in assets is the way to go.

The book also talks about using the tax code to your advantage. It shows how running a corporation can lower your taxes. Kiyosaki says smart decisions, not just hard work, lead to wealth.

He stresses the importance of financial independence. He encourages us to focus on skills and assets that make money without needing us to work for it.

“Rich Dad Poor Dad” encourages taking risks to achieve financial success. It talks about having multiple income sources for security. It highlights the need for good financial management and a strong financial IQ.

“The poor and the middle class work for money. The rich have money work for them.”

The book challenges traditional advice on job security. It promotes building assets that make money. It teaches that true wealth means making money work for you, not the other way around.

Kiyosaki’s ideas on assets and liabilities offer a new way to think about money. He questions the idea that a house is always an asset. He says it only counts as one if it makes rental income.

The book also talks about the benefits of legal entities for taxes. It shows how corporations can save you money.

In summary, “Rich Dad Poor Dad” by Robert Kiyosaki offers a new way to learn about money. It encourages a wealth mindset, helps overcome financial barriers, and teaches us to adapt to changing financial situations.

The Magic of Thinking Big and Achieving Success

Cultivating a Positive Mindset

“The Magic of Thinking Big” by David J. Schwartz shows how a positive mindset can change lives. He says believing in oneself and thinking big helps people reach their goals. This book teaches us to believe in ourselves and overcome challenges.

It’s key to have a positive mindset and avoid negative thoughts. Success isn’t just about working hard or being talented. It’s also about how we think and see ourselves. By thinking positively, we gain confidence and the drive to go after our dreams.

“The Magic of Thinking Big” talks about “excusitis,” or the habit of making excuses for failure. Schwartz looks at different excuses like health, intelligence, age, and luck. He gives advice on how to beat these excuses and stay positive about health, smarts, and age.

Schwartz believes success is within reach for regular people who believe in themselves. He offers tips on gaining confidence, like facing fears and keeping a positive outlook. He also talks about the power of thinking big, including using the right words, having a clear vision, and setting big goals.

“The Magic of Thinking Big” by David J. Schwartz is a great guide for those wanting a positive mindset and success. By following its advice on self-confidence and positive thinking, readers can change their lives for the better.

“Success is not something you pursue. Success is something you attract by the person you become.” – David J. Schwartz

Unveiling the Millionaire Next Door

The book “The Millionaire Next Door” by Thomas Stanley and William Danko challenges old ideas about wealth. It shows that real millionaires save and invest wisely, not just spend a lot. They live modestly and build wealth over time.

Since its release in 1996, the book has sold over 3 million copies. It’s a top pick in personal finance books. The authors talk about “prodigious accumulators of wealth” (PAW) and “under accumulators of wealth” (UAW). They show that most millionaires in America are actually careful with money, saving and investing instead of spending a lot.

Many millionaires in the book started with little and worked hard to get rich. The authors stress the need to know about money to get wealthy. They say it’s not just about how much you earn or spend.

“The Millionaire Next Door” cautions against generalizing millionaires’ behaviors based on societal stereotypes, showing that wealthy individuals come from diverse backgrounds and lifestyles.

The book teaches the key to getting rich is to spend less than you make. It gives tips on saving, investing wisely, and avoiding debt. It uses real stories and facts to show how rich people manage their money.

“The Millionaire Next Door” clears up wrong ideas about wealth. It gives clear steps to build lasting wealth, no matter your income or background. It tells readers to think differently about money and shows how to take control of their finances.

The Simple Path to financial books: Index Investing

In the world of personal finance, The Simple Path to Wealth by Jim Collins is a top choice for those looking for a simple way to wealth. This book highlights the benefits of index investing. It’s a strategy that’s becoming more popular among smart investors.

Collins, an experienced investor, shows that you don’t need complex strategies or picking stocks yourself to succeed. He suggests a passive, long-term way to build wealth with index funds. These funds follow the market’s performance and often beat many actively managed funds.

The main idea is that index investing and saving regularly can lead to financial freedom. Collins shares stories of people who went from debt to a million-dollar net worth in a decade. They followed this simple investment plan.

Take Carl and Mindy Jensen, for example. They became millionaires by investing in index funds like the Vanguard 500 Index Fund Admiral Shares (VFIAX) and the Vanguard Information Technology Index Fund ETF (VGT). They credit their success to the advice in The Simple Path to Wealth. This book talks about the benefits of investing in low-cost index funds over time.

Collins looks at the S&P 500 index’s history. It has grown about 10.7% each year since 1957. Legends like Warren Buffett also support passive investing through index funds. This adds to the argument for this investment strategy.

For those wanting financial freedom, The Simple Path to Wealth by Jim Collins is a clear guide. By following index investing, readers can manage their money better. They can start a path to real wealth and security.

“Time is your friend; impulse is your enemy.” – Jim Collins, author of The Simple Path to Wealth

Conclusion

This article has looked at financial books that can change your life. They teach you about managing money and how to think positively about wealth. These books give you the tools to control your finances and gain financial freedom.

Reading and applying the lessons from these books can strengthen your financial skills. You’ll make better choices and start moving towards success and happiness. Books like “Rich Dad Poor Dad,” “The Barefoot Investor,” and “Financial Institutions in Distress” share valuable advice for building wealth and financial independence.

It’s important to keep learning about personal finance and be ready to act on what you learn. With the right mindset and resources, you can overcome financial challenges. You can achieve your financial goals and dreams by using the knowledge from these books.