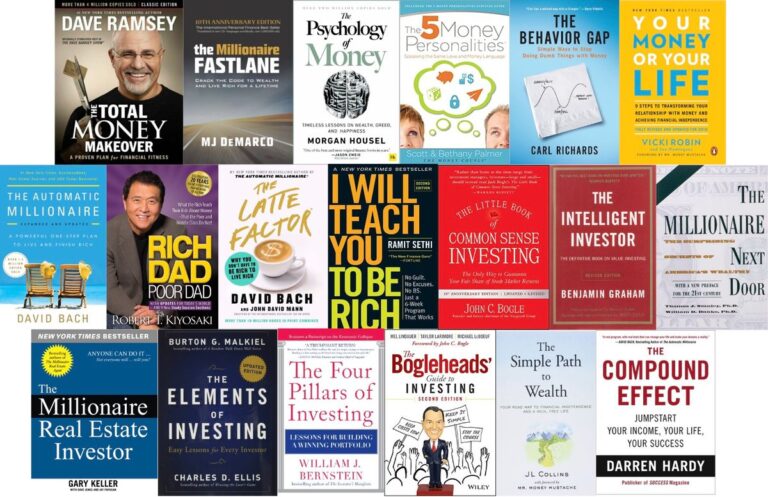

Improving your financial literacy is key in today’s world. It helps you manage your money well, make smart investment choices, and plan for the future. Luckily, there are many free resources out there to boost your financial knowledge and skills. This article will cover 10 valuable financial resources, like personal finance blogs, online courses, podcasts, and more. By using these resources, you can take charge of your finances and reach your financial goals.

Key Takeaways

- Explore a variety of free financial resources to improve your money management skills.

- Learn from personal finance experts through blogs, online courses, and podcasts.

- Utilize interactive financial education platforms to enhance your financial literacy.

- Stay informed about the latest financial news and trends through reputable sources.

- Discover tools and resources to help you make informed financial decisions.

Personal Finance Blogs: Learning from Experts

Personal finance blogs are great for learning from experts in personal finance. They cover topics like budgeting, saving, investing, and retirement planning. These blogs give you useful info, advice, and insights for your financial goals.

Popular Personal Finance Blogs

Some top personal finance blogs are:

- The Vault (Education First’s finance blog)

- The Penny Hoarder

- NerdWallet

- Get Rich Slowly

These blogs share the latest financial trends and strategies for managing money well.

Benefits of Reading Personal Finance Blogs

Reading personal finance blogs has many benefits. They help you:

- Keep up with the latest in personal finance

- Learn more about financial concepts

- Get advice from experts

Regularly reading these blogs can boost your financial knowledge and help you make smart money choices.

| Blog | Visitors | Year Established |

|---|---|---|

| Financial Samurai | Over 100 million | 2009 |

| Get Rich Slowly | N/A | 2006 |

| Clever Girl Finance | N/A | N/A |

By reading personal finance blogs often, you can stay updated, learn more, and make better financial choices. The advice and knowledge on these blogs are key to reaching your financial goals.

Online Courses: Expanding Your Knowledge

Online courses are now a great way to learn about finance easily. Sites like Coursera, Khan Academy, and Udemy offer free courses. These cover everything from basic money skills to complex investment strategies. You can learn at your own pace, fitting it into your schedule.

Platforms Offering Free Financial Literacy Courses

Coursera, Khan Academy, and Udemy are top choices for free financial education courses. Coursera’s “Create a Budget with Google Sheets” course is a hit, with 8,000 students and a 4.7 rating. Khan Academy has tons of personal finance videos and lessons for all levels. Udemy’s “Personal Finance 101” course is a big hit, with over 55,000 students and a 4.5 rating.

These courses aim to be fun and useful, giving you the skills to manage your money better. By joining these financial literacy courses, you’ll learn about budgeting, saving, and investing. This can greatly improve your financial health.

| Platform | Course Name | Enrollments | Average Rating |

|---|---|---|---|

| Coursera | “Create a Budget with Google Sheets” | Approximately 8,000 | 4.7 out of 5 stars |

| Udemy | “Personal Finance 101: Everything You Need to Know” | Over 55,000 | 4.5 out of 5 stars |

| Khan Academy | Various personal finance videos and interactive lessons | N/A | N/A |

Using these free online financial courses, you can learn a lot, get important skills, and make better financial choices. This can really help your financial health.

financial resources: Podcasts for On-the-Go Learning

In today’s digital world, podcasts are a great way to learn about personal finance. They let you listen to experts and industry pros while doing other things. This makes the most of your time. You get a steady flow of financial tips and insights, keeping you informed and motivated to get better at managing money.

Top Financial Podcasts

There are between three million and four million podcasts out there, and they’re listened to by millions of people. By 2024, the number of listeners is expected to hit 504.9 million, says eMarketer. Some top financial podcasts include:

- The Dave Ramsey Show, offering nearly three hours of content daily, split into three one-hour episodes.

- We Study Billionaires, a hit with over 150 million downloads, focusing on stock investing. It drops new episodes on Tuesday, Monday, Thursday, and Saturday.

- Money For the Rest of Us, with new episodes every Wednesday, lasting 25 to 30 minutes.

- BiggerPockets Money, available Monday and Friday, with episodes lasting 60 to 90 minutes.

- ChooseFI, dropping episodes on Monday and Friday, with 30 to 75 minutes of content.

- Afford Anything, with episodes at random times, lasting from 10 to 90 minutes.

- Millennial Investing, aimed at people 18 to 40, teaching them to improve their financial literacy and investment skills.

Benefits of Listening to Financial Podcasts

Financial podcasts offer many benefits for learning about personal finance:

- Accessibility and Convenience: You can listen to them anytime, whether you’re commuting, doing chores, or just relaxing.

- Diverse Topics and Perspectives: They cover everything from investing to budgeting, with insights from experts and leaders.

- Continuous Learning: You get a constant flow of new info and strategies, keeping you updated and motivated.

- Personalization: With so many podcasts out there, you can find ones that match your interests and needs, making learning more enjoyable.

Adding financial podcasts to your daily routine can open up a world of knowledge and insights. This empowers you to make better financial decisions and reach your goals.

Financial Education Platforms: Interactive Learning

Financial education platforms are changing how we learn about money. They offer hands-on experiences that boost financial literacy. Users can learn by doing and apply what they learn to real life.

Mint is a top personal finance app with many features. It links to your bank accounts and investments, giving you a clear view of your finances. It has tools for budgeting, tracking expenses, and alerts for spending.

Investopedia is a leading site for learning about finance. It has tools like stock market simulators and calculators. Users can explore investment strategies and financial concepts to make better decisions.

MyMoney.gov is a government site with lots of financial education. It has quizzes, worksheets, and modules on saving, credit, and retirement planning.

“Financial education platforms are revolutionizing the way people learn about money management. These interactive tools make the learning process engaging and accessible, helping individuals develop the skills they need to achieve financial wellbeing.”

Zogo is a financial literacy app that uses games to teach. Users can earn rewards like gift cards by completing lessons and quizzes. It’s easy to learn about finance with its short lessons.

These platforms help people understand personal finance better. They build skills in managing money and help make smarter financial choices for the future.

| Platform | Key Features | Unique Selling Point |

|---|---|---|

| Mint |

|

Centralized financial management |

| Investopedia |

|

Comprehensive financial education |

| MyMoney.gov |

|

Government-backed financial resources |

| Zogo |

|

Engaging and rewarding financial education |

Conclusion

There are many free financial resources out there to help you get better at managing money. You can find personal finance blogs, online courses, podcasts, and more. These tools are great for different ways of learning and what you like.

By using these resources, you can improve your financial health, reach your money goals, and look forward to a better financial future. The important thing is to check out all the options and pick what works best for you.

Maybe you like reading blogs, taking online courses, or listening to podcasts. There’s something for everyone. By using these free resources often, you’ll get better at handling money, investing, budgeting, and more. This will help you make smarter choices and control your financial future.

Getting better at managing money is a journey that never stops. These free resources can be a big help on your way to financial stability and success. So, use all the information and advice out there. Start your journey to a more secure and prosperous financial future today.